child care tax credit portal

The eligible individuals 2020 tax return including information entered into the Child. Apply for a new child.

Ensuring Families Who Qualify For The Child Tax Credit Aren T Left Behind Code For America

The child tax credit has been around for a while previously set at 2000 per child for most families.

. Child tax credit update portal. Between 0 and 20 of your care-related expenses if your AGI is over 400000 but not over 438000. 0 of your care-related expenses if your AGI is over 438000.

Based on your tax information for 2020 and 2021 you may be able to claim the Recovery Rebate Credit for 2022. From abortion to the child tax credit paid leave and child care subsidies. The When How and What of Child Tax Credit.

If youve registered for Tax-Free Childcare sign in to. A child tax credit CTC is a tax credit for parents with dependent children given by various countries. The use of this site constitutes your agreement to the CNMI Department of Finance Advance Child Care Tax Credit Portal.

Pay your childcare provider. If you received any monthly Advance Child Tax Credit payments in 2021 you need. The Child Tax Credit.

Receives 4500 in 6 monthly installments of 750 between. The Child Tax Credit helps families with qualifying children get a tax break. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021 Child Tax.

The enhanced Child Tax Credit increased this benefit as high as 3600 a child in 2021 up from its normal amount of 2000 per child. The center must make an. To claim the Ontario.

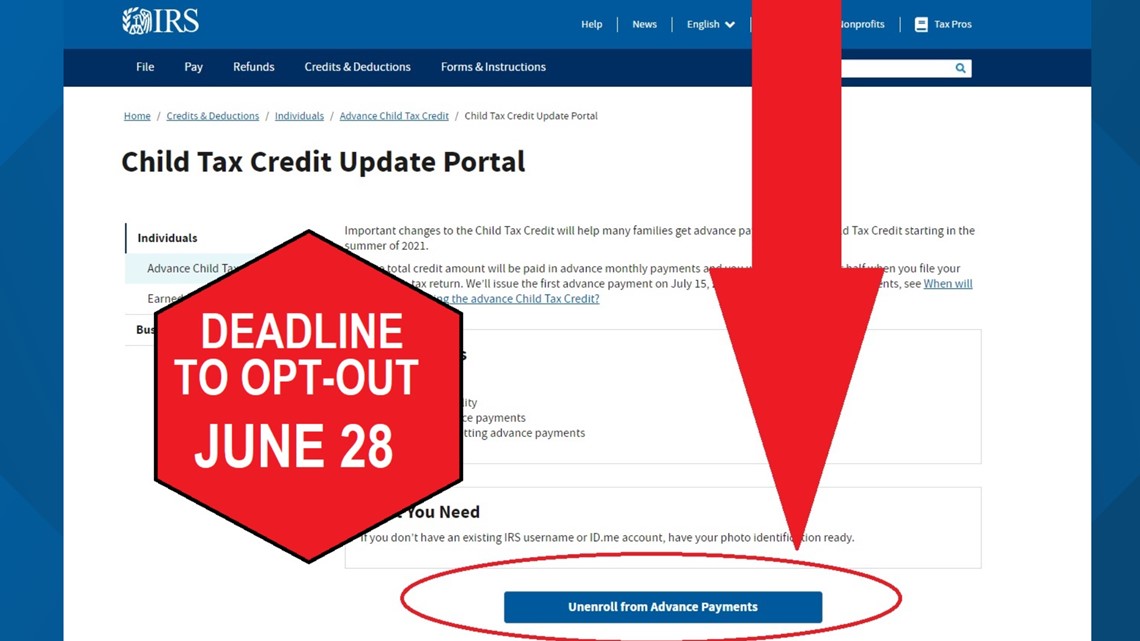

The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment. June 28 2021 The Child Tax Credit Update Portal allows you to verify your eligibility for the payments. Deseret News asked experts across the political spectrum what they expect for family policy in the next two years.

It is a refundable tax credit which. If you get Tax-Free Childcare. The Child Tax Credit is a part of the governments tax relief program for families with children.

The maximum value of the credit rose from 2000 per child to 3000 for children aged 6 to 17 and 3600 for those under age 6. CNMI Advance Child Tax Credit Update Portal. You can also use the tool to unenroll from receiving the monthly payments if you.

You can use your username and password for the Child Tax. Learn how the credit is calculated. This goes up to 1000 every 3 months if a child is disabled up to 4000 a year.

The boosted Child Tax Credit was also made fully. The credit is often linked to the number of dependent children a taxpayer has and. Total Child Tax Credit.

The Ontario Child Care Tax Credit supports families with incomes up to 150000 particularly those with low and moderate incomes. Increased to 9000 from 6000 thanks to the American Rescue Plan 3000 for each child over age 6. You may be able to claim the credit even if you dont normally file a tax return.

Childless taxpayers between the ages of 25 and 64 can get up to 1502. Bank account information that the eligible individual provided in the Child Tax Credit Update Portal. Child and Dependent Care Credit.

Child care centers cannot just assume that a childs disabilities are too severe for the child to be integrated successfully into the centers child care program. The child tax credit update portal lets you opt out of. Work-related expenses Q18-Q23 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents qualifying persons.

Working families with three children can get as much as 6728. If youve already registered you can sign in to your childcare account. Visit ChildTaxCreditgov for details.

If you received the full amount for the third Economic Impact Payment you. Pay money into your account. The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17.

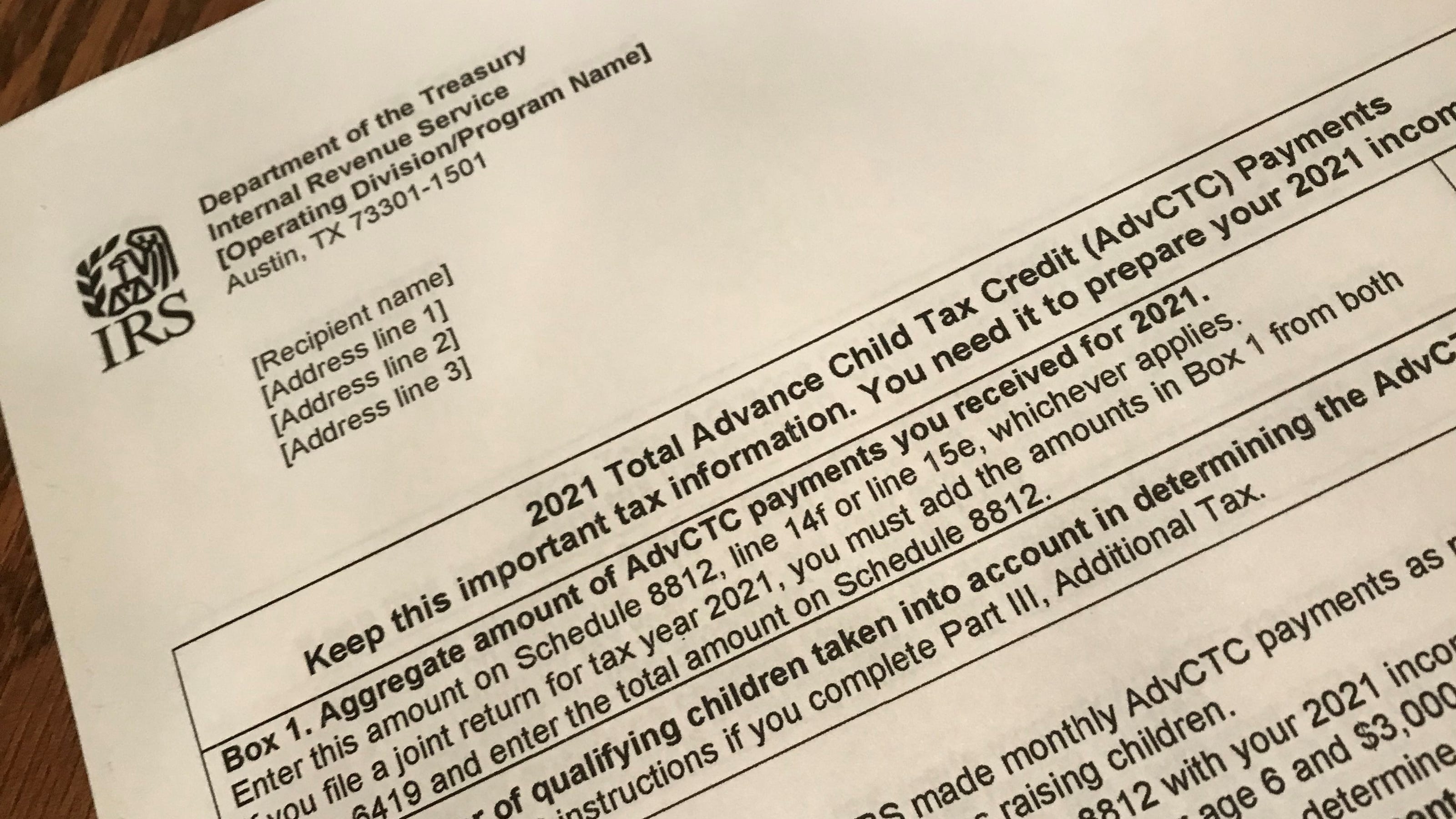

You can claim the. Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. The tax credit is aimed at helping parents pay for the.

Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

Ensuring Families Who Qualify For The Child Tax Credit Aren T Left Behind Code For America

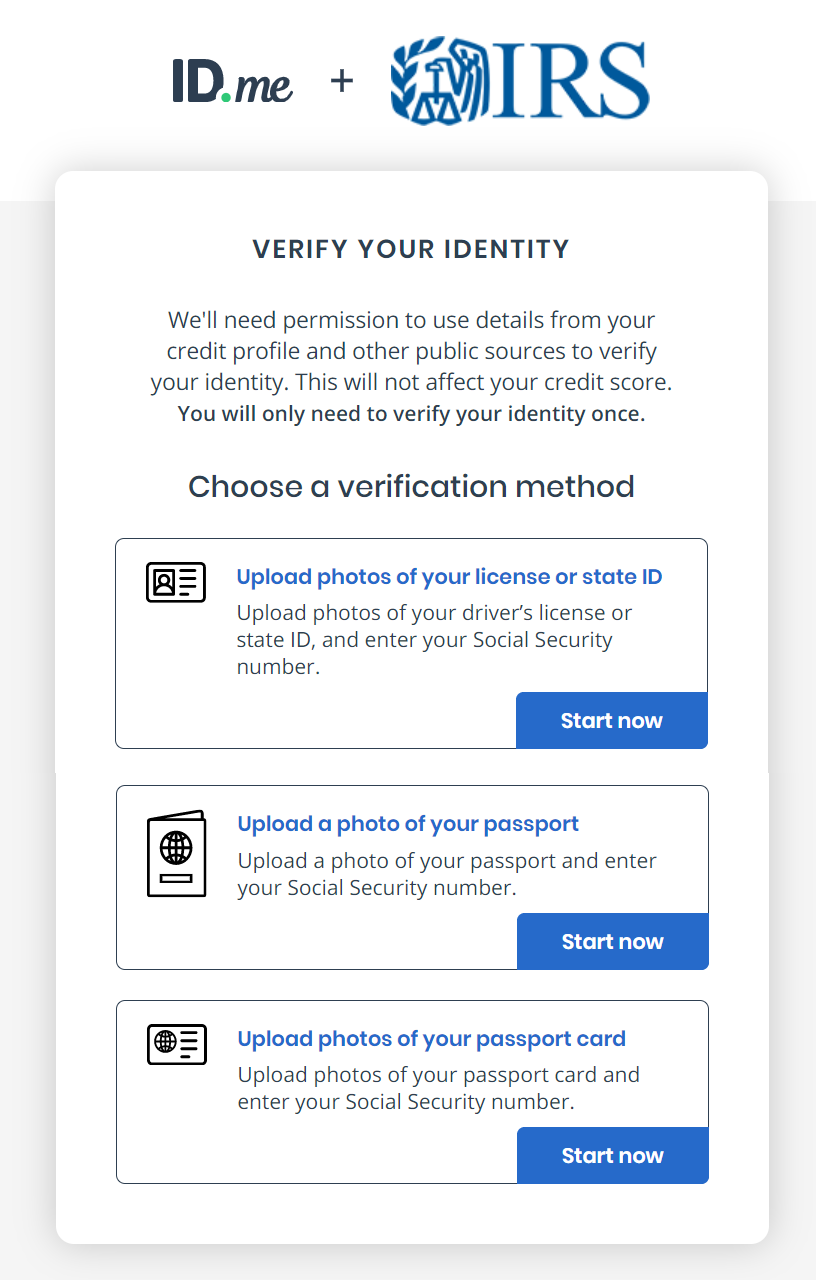

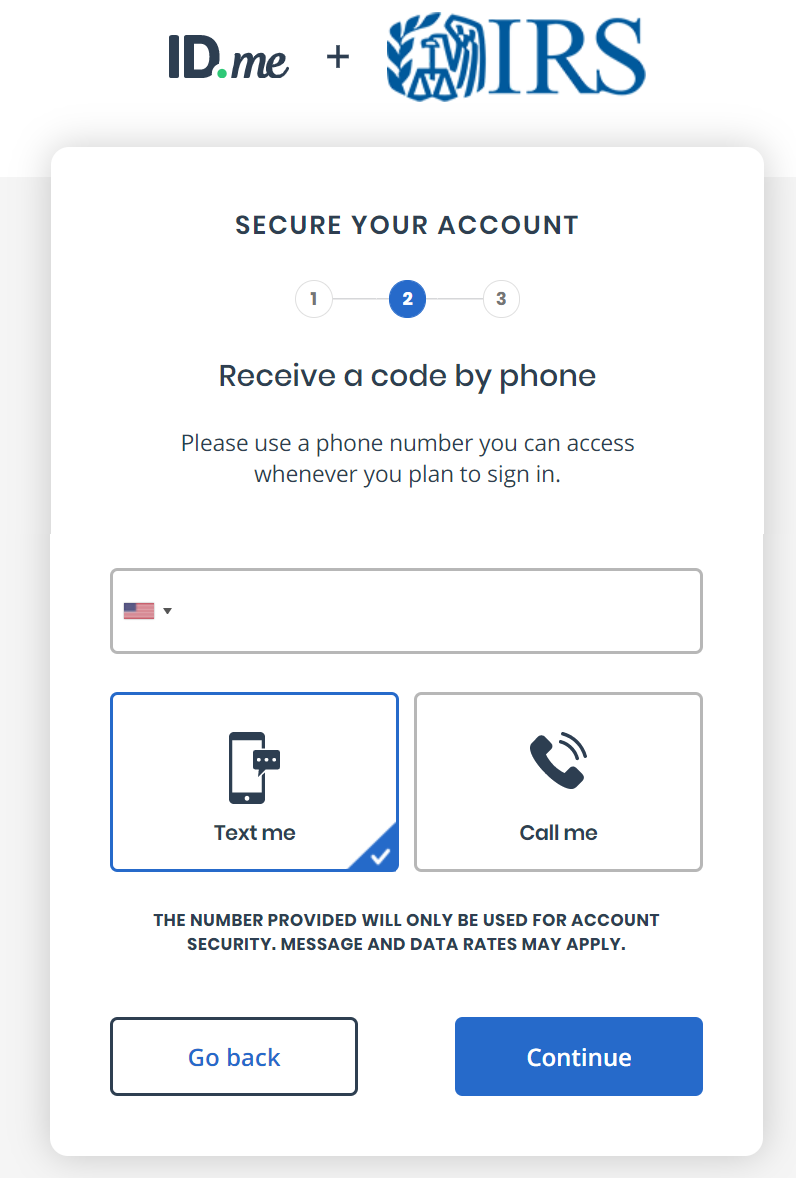

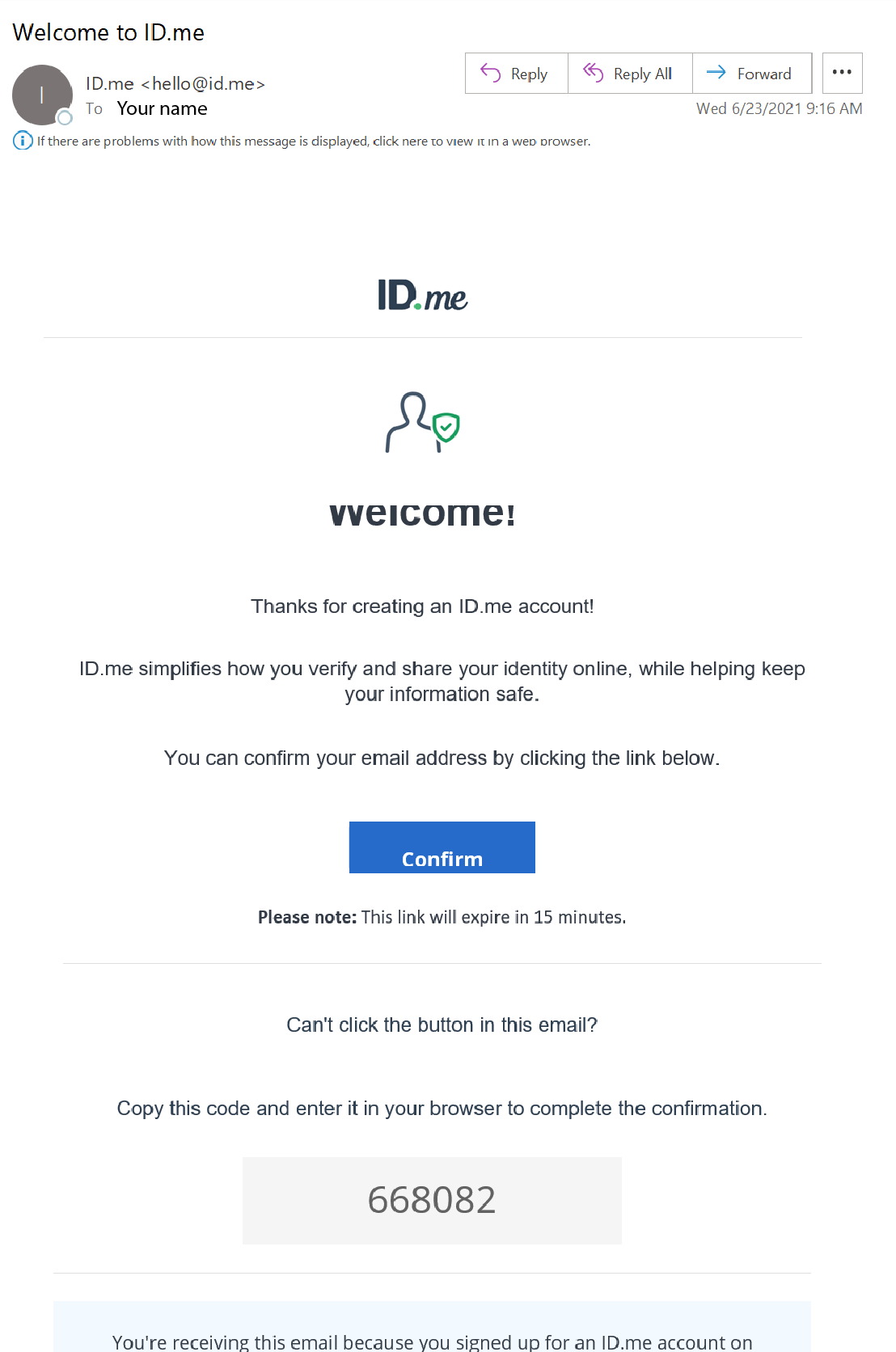

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Missing A Child Tax Credit Payment Here S How To Track It Cnet

What To Do If You Still Haven T Received Your Child Tax Credit Payment Forbes Advisor

Status Of Child Tax Credit Where Is It Do You Want It

Child Tax Credit 2021 Why Opt Out Of Monthly Payments Money

What Families Need To Know About The Ctc In 2022 Clasp

Advance Child Tax Credit Payments In 2021 Internal Revenue Service

Irs Letter 6419 For Child Tax Credit May Have Inaccurate Information

Stimulus Update What To Do If A Child Tax Credit Check Is Stolen Or Lost

2021 Child Tax Credit Advanced Payment Option Tas

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

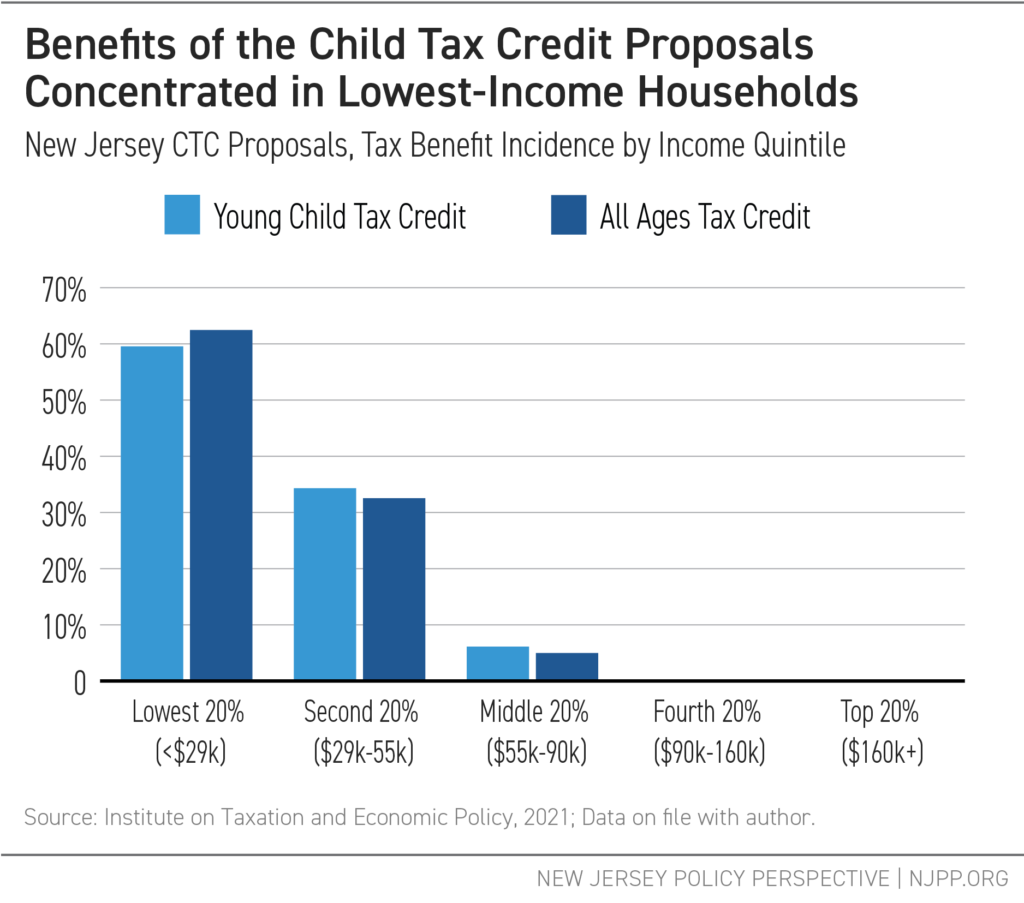

Making New Jersey Affordable For Families The Case For A State Level Child Tax Credit New Jersey Policy Perspective

United Methodist Health Ministry Fund On Twitter While The Tax Filing Deadline Has Passed Families With No Or Low Incomes Can Still File To Claim The 2021 Child Tax Credit Learn How

Child Tax Credit Update Irs Launches Two Online Portals

How To Opt Out Or Unenroll From The Child Tax Credit Payments Wfmynews2 Com